How to Get Your Indirect Cost Rate if EDA is Your Cognizant Agency

Regardless of the type of organization you are (non-profit or unit of local government), if you intend to include indirect costs as part of your federal award budget, you must have documentation of your indirect cost rate.

Please note: This does not apply to organizations that elect to take the 10% de minimis rate for their federal award.

You are required to develop and maintain for your annual audit an indirect cost rate proposal in accordance with 2 CFR part 200. This is an annual process and should therefore be done every year and should be based on your most recent audited financial statements.

The instructions below apply only to non-profit organizations and units of local government for which EDA is the cognizant agency. There are separate sets of instructions for each entity type as indicated below.

Non-Profit Entities

Non-profit and commercial entities are required1 to secure and maintain a current indirect cost rate from their cognizant agency to receive funding for indirect costs under an award. To determine the rate, applicants must complete an indirect cost proposal and submit it to their cognizant agency. The cognizant agency will review the proposal and, if approved, the rate will be authorized for a set period and for a specific rate for various types of projects.

Note: EDA designated Economic Development Districts (EDDs) organized as non-profit organizations may be subject to the same requirements as other non-profit and commercial applicants under 2 C.F.R. part 200, Subpart E, unless they have provided the appropriate documentation to show they should be treated as a unit of local government for the purposes of indirect cost rates.

Obtaining your NICRA

If you need a negotiated indirect cost rate agreement (NICRA) and EDA is your cognizant agency, you must prepare your full indirect cost rate proposal (ICRP) in accordance with 2 CFR part 200, and it is recommended that you use the templates available on DOI’s website (links provided below).

- General Information: https://ibc.doi.gov/ICS/indirect-cost/nonprofit

- Templates: https://ibc.doi.gov/ICS/indirect-cost/nonprofit/templates

Once a complete ICRP is developed, you must send an email to DOI at EDA_Indirect@ibc.doi.gov with the following:

- Subject line: [Name of Org] – FY[Insert year you are requesting a rate for] – ICRP

- Body of text:

Hello,

Attached is our indirect cost rate proposal for your review. The proposal requests a [insert type of rate] FY xxxx (add additional rates and years as needed).

Included in the proposal:- Signed Certificate of Indirect Costs

- Rate Information Narrative and Cost Policy Description

- Indirect Rate Calculation and supporting schedules

- Audited Financial Statements (or Profit & Loss Statement if no audited financials) for FY xxxx

[Name] - Attachments: Full ICRP, including the checklist, recent audited financials

Your ICRP will be entered into the queue for review. Once a negotiator is available, he/she will reach out to you with any initial questions they have about your ICRP.

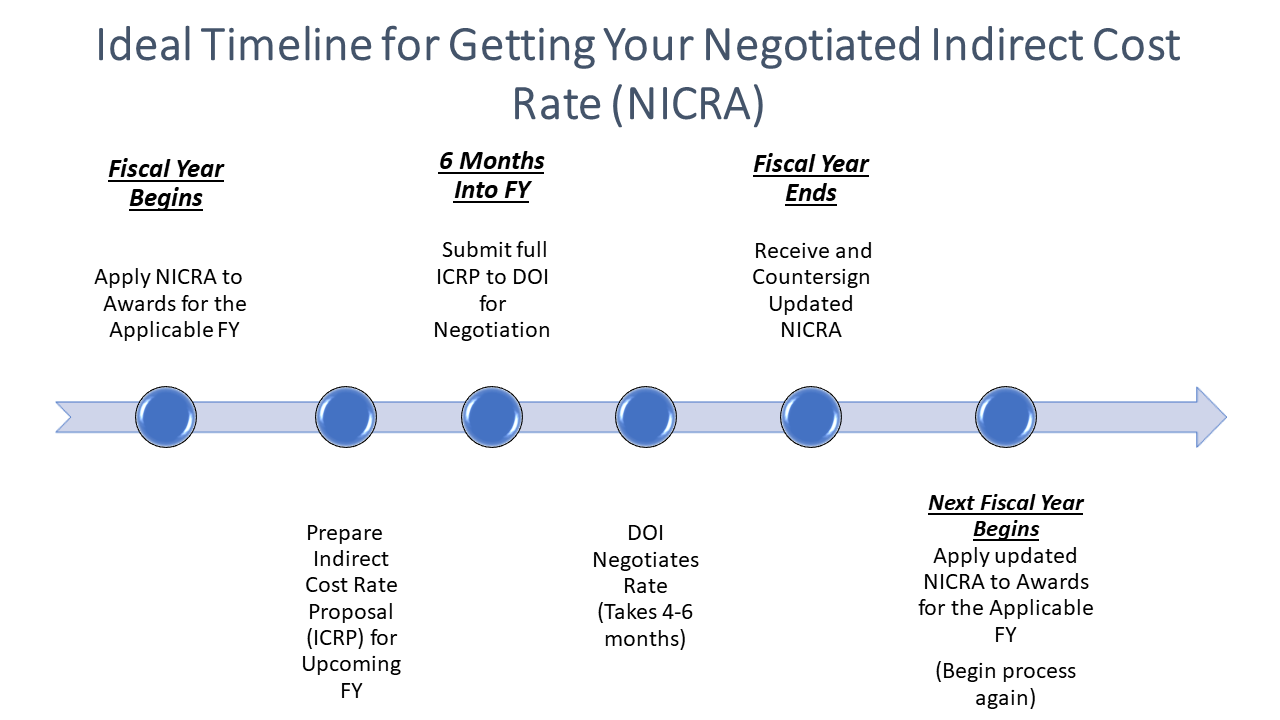

The negotiation process can take about four to six months (date of submission to date of signature on the NICRA) depending on the time of year and how complex your proposal is.

Units of State or Local Government

EDA will not approve Cost Allocation Plans (CAPs) in lieu of having an indirect cost rate. While CAPs can be a component of the indirect cost rate calculation, a CAP alone does not adequately provide a rate for determining the amount of indirect costs that can be charged to an award.

States and local governments receiving less than $35 million in direct federal funding annually are afforded special administrative privileges relative to documenting indirect costs. Because these entities are subject to annual audits and detailed financial oversight, they are not required to get a NICRA or submit their indirect cost proposal to EDA[2] unless EDA specifically requests the proposal.

Instead, it is their responsibility to maintain sufficient records and oversight to ensure they are properly accounting for and tracking these costs, including developing a new indirect cost proposal, six months before the expiration of the current indirect cost rate if they have one, or six months after the end of their fiscal year using most recently audited financial statements.

For EDA’s purposes, designated Economic Development Districts (EDDs) that qualify as governmental entities under state law can be considered units of local government for indirect cost determinations. Other EDDs not organized as units of government may be required to submit their indirect cost rate proposal for review and negotiation.

Please note: While the majority of Economic Development Districts (EDDs) are considered to be units of local government for the purposes of indirect costs, not all are. This is a legal determination that is made through a review of your Articles of Incorporation and Bylaws, and applicable state statutes and executive orders.

Even though not required to submit an indirect cost proposal to EDA, state/local government organizations and Indian tribes receiving less than $35 million annually in direct Federal funding may still request a negotiated indirect cost rate from EDA. This process will take about 4 to 6 months from time of request. Absent a request for a negotiated indirect cost rate, EDA or DOI on behalf of EDA will, upon request, provide a letter acknowledging receipt of the Certificate of Indirect Costs and other supporting information.

All indirect costs claimed in the Certificate of Indirect Costs are subject to audit, and it is the responsibility of the state, tribal and/or local government or EDA-designated District Organization to retain all appropriate records to address audit findings to prevent disallowed costs under an award.

Note the following:

- EDA, or another Federal Agency, may request a full review of the indirect cost proposal at any time. EDA may request that the organization get a negotiated indirect cost rate if the rate appears to be potentially unreasonable or varies significantly from other organizations that initially appear to be similarly situated.

- Alternatively, states, tribes and local governments may choose to take the 15% de minimis rate.

Obtaining your Acknowledgment Letter

If you need an acknowledgment letter and EDA is your Federal cognizant agency for indirect costs, you must send an email to DOI at EDA_Indirect@ibc.doi.gov with the following:

- Subject line: [Name of Org] – FY[insert year of rate] – Certificate of Indirect Costs

- Body of text:

Hello,

My name is _____ and I am with [name of organization]. Attached is our Certificate of Indirect Costs for FY[insert year]. I am requesting an acknowledgment letter.

Thank you,

[Name] - Required Attachments: Signed Certificate of Indirect Costs

- Optional Attachments: Full indirect cost rate proposal (EDA reserves the right to request this proposal at any time)

By signing the Certificate, you are certifying that you have developed your full indirect cost rate proposal and that everything in the Certificate is true and correct, in accordance with 2 CFR part 200. View the Certificate of Indirect Costs Template (PDF).

Your request will be reviewed by staff at DOI and someone will reach out to you if they have any questions. DOI will generate an acknowledgment letter in accordance with EDA’s policy guidance and provide an email response.

You should allow 2 weeks for this process.

Obtaining your NICRA

If you are a unit of government and would like to request a negotiated indirect cost rate agreement (NICRA), and EDA is your Federal cognizant agency for indirect costs, you must prepare your full indirect cost rate proposal (ICRP) in accordance with 2 CFR part 200 and it is recommended that you use the templates available on DOI’s website (links provided below).

- General Information: https://ibc.doi.gov/ICS/indirect-cost/nonprofit

- Templates: https://ibc.doi.gov/ICS/indirect-cost/nonprofit/templates

-

- In many cases, the non-profit templates will be more applicable to your organization than the templates available for Insular Areas, State, and Local Governments here: https://ibc.doi.gov/ICS/indirect-cost/insular-state

Once a complete ICRP is developed, you must send an email to DOI at EDA_Indirect@ibc.doi.gov with the following:

- Subject line: [Name of Org] – FY[Insert year you are requesting a rate for] – ICRP

- Body of text:

Hello,

My name is _____ and I am with [name of organization]. Attached is our Certificate of Indirect Costs for FY[insert year]. I am requesting an acknowledgment letter.

Thank you,

[Name] - Attachments: Full ICRP, including the checklist, recent audited financials

Your ICRP will be entered into the queue for review. Once a negotiator is available, he/she will reach out to you with any initial questions they have about your ICRP.

The negotiation process can take about four to six months (date of submission to date of signature on the NICRA) depending on the time of year and how complex your proposal is.

--------

1. Unless the entity elects to apply a 15% de minimis rate to the Modified Total Direct Costs (MTDC)

2. See 2 C.F.R. part 200, Appendix VII § D.1.b.